The Issuance of Debt-Free Money

(That would end the income tax-war-debt usury system)

"The government should

create, issue and circulate all the currency and credit needed to

satisfy the spending power of the government and the buying power of

consumers..... The privilege of creating and issuing money is not only

the supreme prerogative of Government, but it is the Government's

greatest creative opportunity. By the adoption of these principles, the

long-felt want for a uniform medium will be satisfied.

"The taxpayers will be saved immense sums of interest, discounts and exchanges. The financing of all public enterprises, the maintenance of stable government and ordered progress, and the conduct of the Treasury will become matters of practical administration. The people can and will be furnished with a currency as safe as their own government. Money will cease to be the master and become the servant of humanity. Democracy will rise superior to the money power." — Abraham Lincoln, on the issuance of the Greenbacks, government issued, debt-free money which is in sharp contrast to the privately owned and controlled "Federal" Reserve.

The Right Way to Go

“Book money [by

banks] is a good modern invention that should be retained. But instead

of it proceeding from a private pen, in the form of a debt, those

figures, which serve as money, should come from the pen of a national

organism, in the form of money destined to serve the people.”

“In practice, here is how it would work: the new money would be issued by the National Credit Office as new products are made, and would be withdrawn from circulation as these products are consumed (purchased)…. Thus there would be no danger of having more money than products: there would be a constant balance between money and products, money would always keep the same value, and any inflation would be impossible. Money would not be issued according to the whims of the Government nor of the accountants, since the commission of accountants, appointed by the Government, would act only according to the facts, according to what [the people] produce and consume.”

Learn the Truth About Money and the Good Economy

that Benefits All

Some things are simply unacceptable

An Unacceptable System:

The Creation of Inequality, Poverty,

a Regressive Society and the Wrecking of Ordinary People's Lives

The Vicious Circle of Debt and Depression

–

It is a Class War

by Ismael Hossein-zadeh

"'Feed a

boom and starve a recession,' is not the way to manage an economy. Only

Social Credit gives a nice even flow of new currency, watering every

household equally and with just enough to keep enterprise and opportunity

flowing steady and independently.”

—

Jim Logel

The Philosophy of Social Credit

The History of Usury Prohibition

Why We Must Adjust our Spectacles

for Another World View

Lincoln's Greenbacks Meet Social Credit for

the Perfect People’s Economy

North American Social Creditor Richard Eastman

|

"Here is

something offered as counsel to governments and nations for

ending debt dependency for the economy as a whole.

It's my opinion, given our current national money "plumbing

system" that even an entire nation of wise and frugal and hard

working as the hard working people providing for American

families, many would still drown in debt simply because of the

way purchasing power (bill-paying power) drains away to high

finance which does not return it. I guess this is free

plumbing advice to this great good country which, we all know,

has become lost in its finances. It is my attempt at "service"

-- combining the best economics I know of to analyze the problem

and come up with a solution. "If you disagree with any or all of this, no matter. A man can design a new kind of wrench to fix plumbing and not expect his good friends to use it or like it. But I do ask that you give at least some thought to the problem this tool is intended to solve. It affects you in big ways." |

The

Two-Tiered Economic System of the Elites

The problem is not

fiat, it's usury. The solution is not gold,

it's social credit and

debt-free treasury notes.

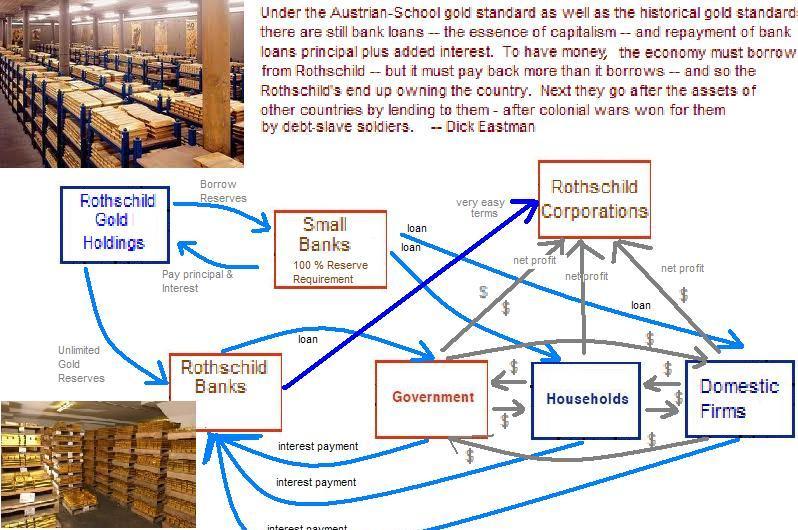

First, A Look into Gold

| There is no magical protection in gold, only fatal error. You are buying from the Rothschilds who have monopoly power to control the gold price -- and when the the American People are totally crushed because they trusted gold and not each other, the men with metal detectors that find your gold by its density and take it from you with no compensation and maybe at the cost of your life if they think you "held out" on them. Ron Paul, Gerald Celente, Glenn Beck may be false-friends -- or else they don't understand what they are talking about. The real answer -- the populist answer -- is something that can quickly bring wealth and happiness to the entire population of every nation that adopts it as their monetary system, but but to have it you must first throw down Rothschild gold and usury. |

*

A Further Comment on Gold

* Gold as Fool's Money

*

The Gold Standard is Not the Answer

"The gold standard puts real money in

yellow chains

—

and there is no freedom where money is in chains."

|

|

Unchaining Freedom

The Way of God — Good to All

*Because all Human Beings Are Created Equal*

*What

is Social Credit?

*

An Economy

That Works for the People

*

The

Good Stewardship of the Nation's Economy

*Expanding

Life, Liberty and Happiness

*The Boom Bust

Cycle

–

This is No Way to Live

*Monopoly

Credit vs Debt Free Treasury Money

*

Repudiate the Debt

*

Question and

Answer Discussion

*

One More

Review of the Basic Idea

*

See the

Monopoly Game

*

How Do Social

Credit Populists View the Economy?

*

The

Beginning of Rothschild Central Banker Fraud and Thievery

* How to Institute Social Credit

and Debt Free Treasury

Dollar Through the Ballot Box

*

The Conspiracy of

Economic Gurus and Pundits Who

will Not Offer Solutions

*

Watching Out for

Charlatans Pushing Social Credit

*

Why Populists Do Not Do Gold

*

The War-Debt-Taxes

System Needs to be Done Away With

*

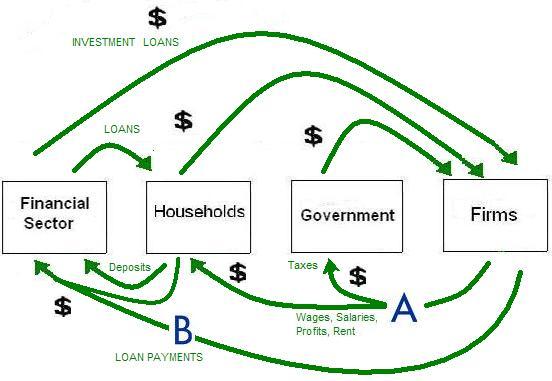

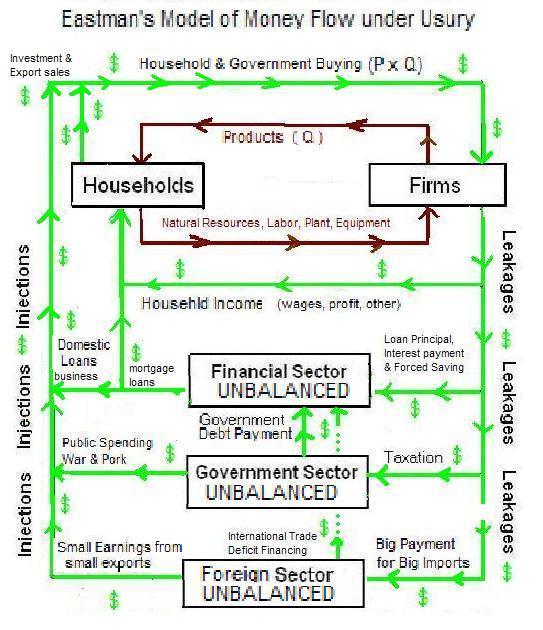

Schematic of a Usury & Non-Usury System

*The

Two-Tiered Economic System

–

The Elite Loop

and the Lower Loop

*No

Monetary Reformer is on Your Side who is not Honest About

Everything

that is Going on in the World

*Social Credit to Replace the Usury and the

Monopoly System

(which includes the Flight and Full Liability of

Corporations)

Through a Constitutional Amendment

* The Logic of Social

Credit is Irresistible, The Benefits Immediate

and Lasting, Deliverance

Within Our Reach

*

Opposing World Views

– Gold Versus Social Credit

*

Social Credit is Fiat Money From The People, To

The People and For

The People So the Market and Profit System Serve Us Instead

of Interest, Monopoly and Rent

*

Understanding More of the

Creditor/Predator Class

Through the Two-Tiered Economic System

*

Social Credit Stands Up to

the Most Rigorous Scholarly Examination,

Whereas the Gold Standard Proposal is Full of Flaws

*

Identifying the Wrong Part in our Malfunctioning National Economic

Engine

and the Right Part Needed to Replace It

*

Why Big Finance

Manipulates Interest Rates

*

Inflation is Being Blamed for

the Crimes of Interest and Deflation

and Bankers who Create New Money but Don't Let Any of it Reach Us

*

History of the House of Rothschild

*

Answering the

Most Important Question a 21st Century Nation Can Ask

*

With Social Credit we

Have a Smooth Running and Prosperous Economy

without Deflation or Over-inflation

*

Social Credit Dividends

* De-Coupling

Social Credit from Gold

and Other Charlatans

*

Bonds and Banking

— The Biggest Conflict of

Interest

* End the Fed for Gold

—

A False Choice

* The

Credit Monopolists, Debt and Rising Prices

* Gold Based Currencies

* Comprehensive Links on

Social Credit

—

Featuring Louis Even

How People Can Fix It All

* Satisfactual

—

Blue Bird Money

*

Social Credit and our Contemporary Economic

Problems

— Youtube

*

Social

Credit and Fiat Money

*

Our Current Money Problems

*

Ron Paul's System of Money Creation through Gold-Backed Loans

only Perpetuates the Debt/Usury Cycle.

|

"It is the

criterion of a just money system that what is both socially and

physically possible should also be made financially possible. "The aim of the economic and financial system is the service of man. The goal of an economic system should be the satisfaction of human needs, the production of goods (the role of the producing system) and the distribution of goods so that they may reach the people who need them (the role of the financial system). Social Credit proposes a technique that would make the production and financial systems serve their purpose." — Eric V. Encina |

|

Betty's Book Report on Social Credit by Richard Eastman |

Today I am going to

tell you about Social Credit.

Everybody knows that

people go to work so they can get money to buy things. The things

people buy are paid for with money people earn by making the things

people buy. And that would be all there is to say about it if it

weren't for a big problem that keeps happening.

Sometimes the good

things people make on their jobs simply don't sell even though everybody

knows people want those things and need those things. When this happens

and selling stops the people who make things have to stop making

them. Companies don't get any money when they don't sell what has been

made and so they don't have enough money to pay all the people who work

at the company. This causes troubles for nearly everyone.

How come there is not enough money for people to buy the things that they can so easily make for each other.

The troubles

start because some of the money that goes around and around from

families to companies and back to families again gets taken away so

there is not enough money being spent so everyone can keep their job and

keep on spending. The big problem is the money that is taken away so it

can't keep going around businesses and families doing good for people.

The reason the money

goes away is that it is only loaned to people, not given to them.

Families and companies have to borrow the money so they will have money

to buy and sell. The people who loan the money to companies and

families give it, but then they expect it back or else they will take

away the house or the companies for themselves. Sometimes the people

who lend the money really want to get those companies for themselves and

get the houses and start making people pay rent who live there.

If people didn't have

to borrow money to get it, then there would always be enough money to

buy things that people make when they go to work. There would be no

problem if everybody just got together and voted to print money and send

some to every family so they could spend it. Doing that is called

Social Credit. With Social Credit the money does not have to be paid

back.

Does everybody

understand what I've said so far?

Social Credit is easy to understand and it is easy to do, but the reason why we don't get our money this way and avoid all the troubles is that very rich bad bankers can steal a lot of money from everybody when money is borrowed instead of being given to people from Social Credit.

Now there is one more

thing you need to know about.

When bad bankers take

away more money than they put in they are stealing the things that that

money could have bought for families if people used Social Credit to put

in new money instead of borrowing.

The bad men don't just

lend money and then get it back and then lend it again right away to

someone else. If that was the way money worked then maybe money

wouldn't be gone away as much and there would be enough going around for

everybody to keep making things and buying things. But the bad men do

something much different. What they do is called usury.

When a man wants to

start a company and give people jobs to make things he goes to the usury

man at a bank and borrows money from him. The usury man writes on a

piece of paper that the man starting the company is to get some new

money from the bank. The company is started and people get jobs and

people have money to buy the things that are made. But then the money

has to be paid back. For every dollar that the man starting the company

borrowed, a year later he has to give back to the usury man a dollar

plus a dime a nickel and some pennies; and sometimes he has to pay

back with each dollar a whole quarter.

That extra money that

has to be paid back for each dollar that the man owning the company

borrowed is called interest. It is called interest because the

extra dime and nickel and penny paid back with the dollar is what makes

the usury man interested in lending to the man with the company in the

first place.

So all the time people

are borrowing new money that comes in but paying back the same amount of

money plus more. Money is always being lost by families and companies

to the bankers.

And this is what causes

troubles. Because all the time the bankers have all that interest they

get and families and companies are short that much for buying what is

produced and keeping companies busy with everybody working. People

lose their jobs. Companies go out of business. And the bankers don't

want to lend money to companies because the companies don't have enough

customers.

But bankers are in the

business of lending money, and if people can't borrow money because the

banker knows the people will never be able to earn enough to pay back

each dollar with an extra dime, nickel and penny because the banker has

taken out all of the money that was going around -- the banker will

look elsewhere for people to lend money to. He will lend money to other

countries. Or he will pay bad people to get countries angry with each

other so they will start a war so that people will have to borrow money

to buy guns and airplanes and ships and bombs to win the war. Then the

banker can lend all of the money he took away as interest and the

companies can hire people again to make the guns and bombs. The bankers

will even cause other kinds of disasters if they can so they can lend

their money to rebuild after the disaster. These are the kinds of

troubles that happen when people get their money from borrowing it from

banks rather than just agreeing that money will be printed up for free

and given to each man, woman and child to spend without having to pay it

back at all.

After thinking about usury and Social Credit I really hope that people will find a way to have Social Credit without usury. If people have Social Credit then companies would make enough money that they could keep everyone hired and make new things and different kinds of things and better things and everyone would have the money to buy the ones they like.

Are there any

questions?![]()

Q: How come people

don't fix the problem by having Social Credit and not having money

that's all borrowed and all that sort of nonsense.

A: That's exactly what

I wondered. So I looked up the word "economics" in the school

encyclopedia and read what it says about what causes companies to go out

of business and people to lose jobs. It didn't say anything about the

real reason of people having to pay interest without extra money being

added so they could pay it. Instead there were two famous men who were

paid by the bankers to give people different reasons why people lost

their jobs and and couldn't buy things.

One man named John and

another named Paul said that when companies couldn't sell that the

government should spend money so companies give new jobs to people who

lost their jobs. But this answer was wrong because the government had

to borrow money before it could spend it, and the leak of interest later

on would more than undo the spending that the government does now. And

besides, the government spending what they want is not the same as the

people having the money to spend it on what they want.

Another man with

another wrong answer was named Milton. Milton said that the banks that

make money should look at prices and if prices go up they should lend

less money and if prices go down they should lend more money. Well, of

course that sounds good, but of course it doesn't fix the problem of

interest draining away the money people have to spend on the goods they

make. Even when prices don't change, the bankers are slowly ending up

taking out more dollars than they have put in. Milton didn't understand

that it makes a difference if there are ten dog food companies making

puppy biscuits with everybody working and selling the puppy biscuits for

fifty cents a box and having only two dog food companies in business and

people without jobs with the price of puppy biscuits still fifty cents

for a box. Another thing that Milton said was that while the people

were incapable of deciding how much money their should be, that the

bankers could be trusted to just lend enough money so that prices

wouldn't change. Milton didn't seem to know that bankers would want

price to go down and the amount of money to go down most of the time --

because everyone owes them money and if prices go down then the money

they are going to get from people paying interest will buy more for the

bankers and the people will have to work harder and longer to get each

dollar, dime, nickle and penny. They also like to have the amount of

money going around to become less and less because then more people will

have to come to the bankers to borrow more and pay back a dollar and a

quarter for each dollar borrowed instead of just a dollar, a dime and a

nickel.

John and Paul and

Milton would not tell people that using money that is borrowed rather

than money that is just made and given to people is what causes

everybody's troubles. It doesn't matter if puppy biscuits are one cent

a box or if they are a million dollars a box as long as people receive

enough money to buy everything they can make and want to own.

To conclude this report

I simply wish to say that I think Social Credit is the best way for

companies and families to get the money they use and that usury is a

very bad way that only does good for a few very bad people.

Teacher: Thank you, Betty. That was very nicely done. However, before you take your seat, I have a question that I would like you to try answering. Some people say that if our money were gold instead of paper or checking account money created by bank loans that prices would not go up and everything would be fine. In light of what you have learned about Social Credit, do you think that could be true?

Betty: I don't see how

it could be true, Miss Shirley. To get gold one has to pay the cost

of getting it out of the ground. And when people hide it

away it doesn't get spent. With Social Credit the money just comes to

every house without people having to do anything. With gold you would

have to either get it out of the ground or borrow or buy it from the

rich people who own it all, and they would want interest. To pay their

debts people would not only have a harder time because money had gone

away in paying interest, but because gold is so hard to get hold of to

put in people's hands in the first place. The gold money would never be

enough and so the bad bankers would prosper at the expense of everybody

else even more with gold than without it.

Teacher: Very good.

You may take you seat. Now class, it is time to put away your reading

notebooks and bring out your geography textbooks.

Richard EastmanNote: Economists mentioned were John (Keynes), Paul (Samuelson), and

Milton (Friedman) ![]()

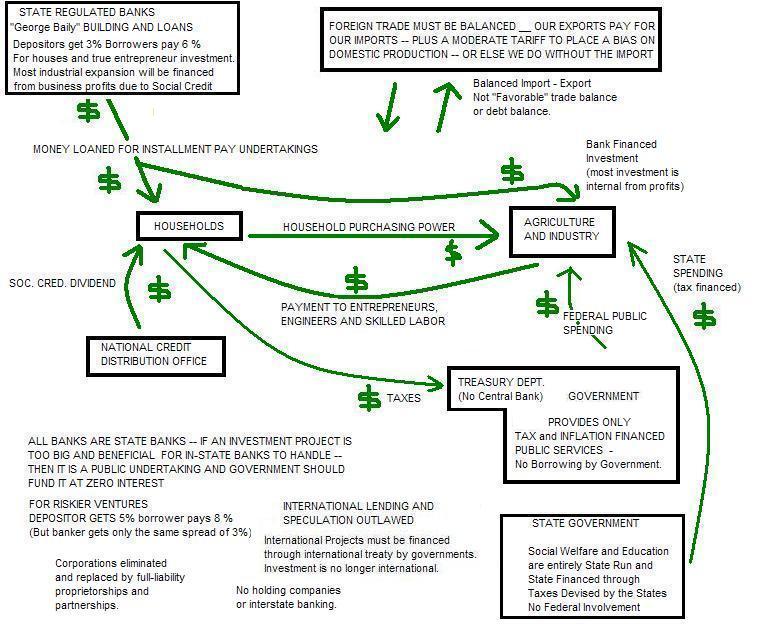

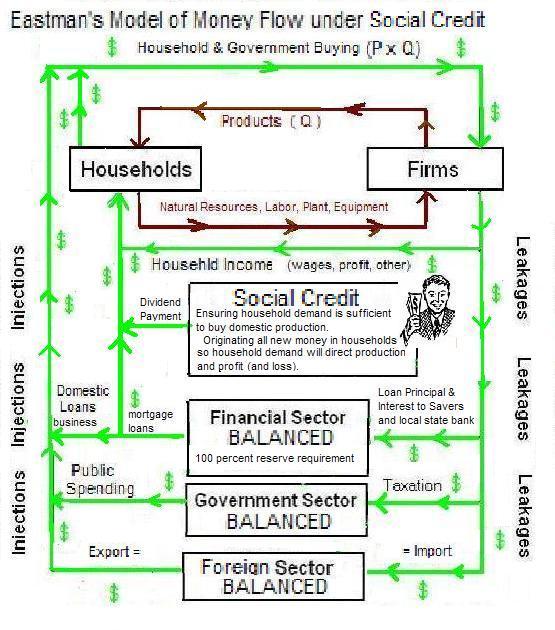

With Social Credit the money first enters the economy as a check to each household, not as a New York bankers loan to a giant corporation. The following diagram presents a version of Social Credit that I propose to impose right away. It would come with repudiation of debt -- or freezing debt paying and then repudiating it later. And instantly providing treasury money to substitute for the purchasing power which High Finance would immediately attempt to dry up and otherwise sabotage. Call it simply the American populists' social credit plan.

|

An Economy That Works for The People |

|

Here is

a populist plan revising the economic system of this republic to

replace Rothschild usury and debt money with Social Credit and

debt-free treasury money. The market system, purged of usury

will remain, while keeping Honest government funded by printing

its own money and taxation will be there if the people want it.

The rewards of intelligence and work and creativity in providing

good things for all people will less obstructed and less limited

than at any other time in recorded history. |

|

The Good Stewardship of the Nation's Economy |

|

Expanding Life, Liberty and Happiness |

|

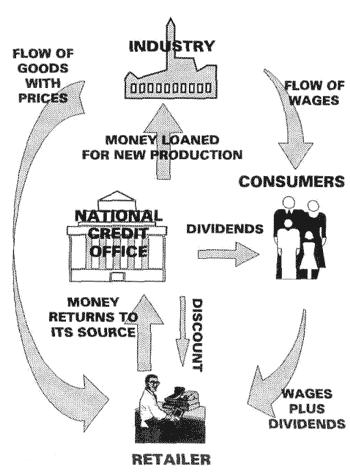

Social credit.

The National Credit office is like an Anti-matter IRS -- not a

penny it issues goes to government. The prime thing is the

dividend going to household and the wages plus dividends going

to businesses (to the retailer who with it pays his suppliers

and his employees). The government sector is not shown here

and neither is the banking sector -- the banks being 100 percent

fractional banking with regulated interest rates -- as in the

1950's when savings accounts earned 3 percent and borrowing

firms and home-buyers paid 6 percent on loans. In short we have

no usury, except the tightly regulated "George Baily" savings

and loans. Banks will all be state run and state regulated --

no Federal Involvement. The banking system will not control the

money supply, -- that will be the job of the Treasury Department

and the Social Credit Institution (called the National Credit

Office in the Diagram above). |

|

The Boom Bust Cycle – This Is No Way to Live |

|

Present

system -- the A + B problem The Financial sector manipulates

us into booms and busts by either expanding loans (and B) or

contracting loans while obligations of firms and houses to pay

on their loans the amount stipulated in the loan contract

remains the same -- forcing bankruptcies and foreclosures. Interest payment obligations, "B," grow in expansion but they do not shrink. Loans are cut back and fewer dollars are in circulation to meet household needs and debt obligations. |

The Vicious Circle of Debt and Depression

–

It is a Class War

by Ismael Hossein-zadeh

|

Which System Would You Rather Have? |

System #1:

The international bankers have monopoly of credit. They keep the credit

tight to maximize loan income and the value of their debt portfolios.

Unfortunately keeping the money supply tight means that the corporations

they invest their money in and buy stock in do not have customers. So,

hiring Israeli intelligence they pay for a false-flag attack in New York

sky scrapers so they can have a war and a great need for anti-terrorism

measures which their defense corporations can cater profitably, solving

the problem of insufficient purchasing power to buy their products.

They also create weather disasters and other disasters with secret

technologies -- because the emergency services business and the

reconstruction businesses are also lucrative -- paid for by government

which borrows the money from the bankers to pay the corporations. etc.

Meanwhile the people not involved with war industry or the disaster

business continue to lose jobs and houses and standard of living

because of lack of purchasing power.

or System #2:

System #2: The government has debt-free treasury money that it creates

without borrowing from international bankers. They give an amount of

money to every American -- not a redistribution of funds, but the

government giving households the chance to spend the new money into

existence -- so that household demand will guide the market economy.

The entire economy will shift away from catering war and disasters --

and from making war and making disasters -- as people receive these

checks and treat them like they would a tax return or a dividend payment

or a pension check. People will still work for a living -- the social

credit does not replace work, or entrepreneurship, or the market system,

or earning a living -- what it replaces is the way new money enters the

economic loop. Let housewives again decide what this country will

make. And under this system the domestic economy will get the stimulus,

because American families do not spend their money on war. Social

credit is the death knell for both finance capitalism and socialism and

the welfare state. There can be no free market system with consumer

sovereignty without social credit. Their can only be poverty and war

without Social Credit.

|

Citizens All Over the World

Unite |

The private credit monopoly is a criminal conspiracy with traitors in government and the courts. Repudiation is the only course, along with compensation for damages and redistribution of their ill-gotten wealth. Remember, that fraud vitiates all contracts -- and executive orders, legislation and decisions from the Supreme Court are null and void if made by a conspiracy intending sabotage. It would be best if all nations and individuals repudiated debt at the same time and with replacement credit systems ready. Treasury money and social credit are the innovations that will make that possible.

Under the Social Credit system we get

rid reliance on the bankers loans based on fractional reserves and with

spendable deposits increased or decreased by the Fed's buying and

selling of securities to the big investment banks, which work their way

to the little banks slowly and imperfectly -- the money often going to

invest in construction in China or other low-wage land ow-environment-user-cost

countries -- THAT SYSTEM IS ELIMINATED. Instead, new money arrives

each month at each household (not to firms) -- this money takes the

place of loan money. It is debt free and it does not have to be paid

back. (No, it is not impossible. It is no less impossible that the

fact that we can finance two wars when were are already busted and sunk

to the center of the earth in a debt hole that neither householder nor

government can climb out of. -- Now let me tell you the secret: We

are killing Iraqis in payment to our Jewish creditors and we are killing

Afghanis and soon Pakistanis in payment to our Chinese creditors. And we

will soon be killing each other for both of them. -- ) As I was

saying, the social credit dividend goes to each household and the

housewife etc. then takes the money to the stores and buys what she

thinks best for her family. Father still goes to work, and mother too

if she prefers that to domestic production of home culture and her own

children's social and cultural development etc -- the householder still

has a job -- but more leisure because he does not have to pay the

Rothschilds -- all debt incurred under the old criminal system has been

repudiated -- and so people need only work a fraction of what they

worked before.

This Social Credit System -- let's call it the American version of

Social Credit -- to distinguish it from the more purist C.H. Douglas

versions that are widely promoted by populists in Australia, Canada, New

Zealand, and, in dark basements of Britain. American Social Credit is a

lazy combination of Douglas, Kitson and Soddy -- taken with a great deal

of artistic license. As I was saying, this Social Credit System gives

money to the householder, who then takes it to become the effective

demand for new goods and services offered by firms. The people not

being entirely wage dependent for their consumption (for their buying)

are able to pay a higher price firm enabling the firm earn some profit

that does not have to be eaten into by payments of "B" the usurer.

The firm can make an honest profit and the amount of purchasing power in

play will not be tampered with by devious criminals in top floor offices

of the Rockefeller Center or the small group of investment bankers who

on the Second Floor of the New York Federal Reserve Bank tell the FOMC

chief (Geitner's old job) what the open market sales and purchases of

securities will be. (Remember, these purchases and sales of treasury

securities between Fed and bankers is what under the present system

expands and contract the supply of loanable funds that finance business

investment and mortgages (i.e. increasing and decreasing spendable

deposits, those debt-based deposits that provide our purchasing power,

such as it is). All that will be shut down under social credit. There

would be no Fed. Money would be created by the Treasury, and credit

would be created by the National Credit Office with every penny of

credit going to household and not to any agency of Government. The

householder will be the first spender, not the government and not the

elite international corporation. The housewife will again (or for the

first time) direct production and become the center of the attention of

profit seeking entrepreneurs as they once again (as not since the 1920's

and early 1950's) do everything they can to satisfy her wants for

herself and her family -- which is called Consumer Sovereignty,

something that only Social Credit really provides without tricks --

without debt and the grand larceny of intentional manipulations of

credit to set up and then knock down households with inflation and

deflation, boom and bust, easy credit and tight credit, investment and

bankruptcy and transfer of assets from workers, entrepreneurs and

engineers to bankers and their crony monopoly corporations.

It is very important that the households receive the social credit

checks and not the government. The big spending Democrat is the partner

of the banker (the Republican IS the banker!) -- I'm speaking of the

decision makers, the policy setters of the party, not the rank-and-file

fool who is led by the nose by deceit and bribes and scares and

seduction and envy and whatever politically useful emotion paid

agitators can stir up. But under Social Credit, the household gets the

money, they spend it on what they think households need most -- what is

best for their children and for their own personal development and

health and future and public contributions they wish to make -- the

American citizen will once again have money to give to charity, even as

charity will not be as necessary -- although there will always be

spendthrifts -- there are other problems which are addressed by

populist remedies other than social credit -- but we are not talking

about those here.

The government will continue to get its money by taxation. It will not

spend the social credit money itself. It will only get that money when

it is paid to them as taxes. There will be no withholding on social

credit. (Very important.)

Social Credit will not replace earned wages. People will still go to

work. But they will not have to work to pay big debt and they will not

have to work to pay their household debt -- except a reasonable mortgage

debt on a bank with 100 percent backing -- people can deposit their

debt-free treasury note money at 3 percent interest and people wanting

to buy a home will borrow at say 6 percent -- which will be fixed for

all time -- inflation being impossible without the dishonest banker

expanding and contracting credit at will. The householder will not

have to work until May or some other late month just to pay the national

debt, the tax to pay interest on the national debt. That debt, to the

Rothschild interests will be repudiated -- as gained by fraud and

malfeasance and the igniting of wars and boom-bust cycles and bubbles

and other forms of financial and government boondoggle scandals. The

Rothschilds and other banking dynasties will have most of their money

taken from them in reparations -- let them go into the wine business or

sell fine art -- under Social Credit the Rothschilds have no function

-- even as they are a dead weight loss on society today -- remember, a

banker is not an entrepreneur -- he only controls entrepreneurs and

engineers and workers because of his monopoly of credit -- the

Rothschild's control too much to be good entrepreneurs -- Investment

Bankers of the City of London and Wall Street care nothing about

pleasing the American housewife, or any other American family member --

the banker profits not from building better a better mousetrap or

computer mouse, and neither does the big corporation -- rather, they

profit by creating monopoly for themselves, monopoly created by

destroying the competition through the shock of damaging expansions and

contractions of credit as already explained.

Governments will tax and they will provide public services. But the

money will originate in the hands of the householders -- not the

government owned by the corporation getting into a war, or building up a

giant Homeland Security boondoggle -- or fake crises that each have to

be met with expenditure of trillions and the regulation and shut down of

everyone not related to a big financier etc.

Businesses will need to apply less for loans because they will be

profitable enough to expand without loans, that is provided they still

can satisfy the housewife, if they can still attract her dollars (social

credit plus wages and profits from business ownership). Social credit

is real free enterprise, the only really workable market system that can

hold up a complex modern society without the scam, boom and bust and all

out corruption of the debt-money private credit monopoly system we now

languish and perish under.

Because the housewife directs production with the purchasing power that

social credit and a husbands paycheck that does not have to go to pay

creditors and the tax man who turns it over to Rothschild as interest on

the National Debt. Motive for war will be gone. Wars, as Hobson showed

over a hundred years ago, is caused by the people not having enough

money to buy what they themselves produce -- so that firms had to sell

abroad (in exchange for raw materials etc.) to sell that they produced

-- giving credit to foreign countries to develop their resources on

condition that they buy from the Imperialist country's firms --

because, as Douglas put it, the domestic population only earned "A"

while the products for sale had to cover both "A" (wages, profits) and

"B" usury -- so that a constant stream of loans by usurers were

necessary to keep firms going -- a responsibility abused by rigging the

game with expansions and contractions until the banker and his pet

monopoly corporations owned everything. The heck with that noise! All

of that will be out of our lives forever -- if and when we -- all

nations -- rise up and overthrow the money power and replace it with

treasury money, social credit, debt repudiation against international

crime banking syndicates..

|

Question and Answer

Discussion on Social Credit |

Discussion

"Mark S

Bilk" & "Richard Eastman"

Mark S. Bilk: Betty did a good job.

[see "Betty's

Book Report on Social Credit,"

above]

But I have a question: Does everyone get the same amount of

social credit money from the government?

Richard P.

Eastman:

Yes.

Mark S. Bilk: Seems to me the amount should be inversely based on income or wealth. No point in giving millionaires extra money -- they already have enough to buy things and keep the economy going. It's the poor and middle-class people who don't, so they should get it. That way you don't give out more than is necessary and risk inflation. Right?

Richard P. Eastman:

Social Credit is not a redistribution instrument. It is not a tool of

social policy. The poor and the rich get about the same amount of

oxygen to breathe and they get the same

amount

of Social Credit. If it were otherwise than immediately Social

Credit would become an instrument for criminal misallocation, for

political argument of how "progressive redistribution" formulas were

arrived at. Politicians would run for office either as Robin Hood or as

George Bush. Political corruption, and in fact political parties of all

kinds, are based on capturing the instruments of redistribution.

Mark S.

Bilk:

And is getting social credit money dependent on working?

Because if it's not, wouldn't people just live off that money and not

work?

Richard P. Eastman:

Receiving a Social Credit dividend check is not dependent on working, or

being needy. Or anything else. If people want to live off that money

they can do so. But without exploitation at the job, with lots of

interesting employers all making profit and able to hire people that fit

their very varied needs -- working is more attractive and easier to

obtain. Most people want to so something and be proud of it. Others --

artists, or maybe people like you and me -- will forego larger incomes

in order to serve others for free -- the self-sacrificing

do-gooder. Everyone wants to work under the right conditions. Those

who don't probably shouldn't. If they don't they shouldn't be a drain

on family members who do work. We have great modern technology --

Social Credit is modernist -- and plenty of resources (despite the lies

of monopolists who seek to hide the reasons behind planned dearth for

higher prices of their monopoly/oligopoly corporations. I think we

need men who don't work -- people who develop themselves in highly

individualistic ways. But for the reasons given, I do not think people

will want to forego work -- and one more reason: Without having to pay

personal debt, and national debt and with such abundance from business

with plenty of demand and no interest payments (i.e. not hobbled by the

"B" in the "A" plus "B" theorem of cost of production plus interest

payment equaling cost of product -- Social Credit eliminates "B"

(interest payment component and related components or it compensates

them with Social Credit making up for the drain of "B") with the

ultimate result that people don't have to work as long to produce the

same amount of product (think of it as less overhead translating into

higher wages and lower prices, i.e., higher "real" wages, or

purchasing. If going to work means only four or five hours a day --

people will not find work adversive. Almost everyone not overworked

enjoys the first one, two or three hours of work. The fourth hour is

tolerable, but work becomes aversive if you are tied to in for longer

periods. Of course the work that is more interesting -- the

professions etc. are especially rewarding for in visible accomplishment

and social status -- individual achievement or love of the craft - or

dedication to the service -- that many will work long hours and like

it. They are free to give their time to work or not -- they are no

longer debt slaves forced to work for Rothschild, Rockefeller and their

debt collector the IRS. Everyone likes work of their own choosing on

their own terms. No one likes to hang out in the street when they can

really be doing something they feel good about. Also people are

competitive -- men will still pride themselves on what they can do,

what they can earn, what they can give their families -- that almost

defines the middle class ethic. Under Social Credit we will all tend

towards that ethic. And that is good -- whatever anarchists or

communists or libertarians or conservatives or progressives may urge to

the contrary. The Rothschild's substitute for the "real thing" has

led us to where we are today.

Mark S.

Bilk:

But that means that there would have to be enough jobs for full

employment. And because of increasing automation, computerization, and

other forms of technology, the standard number of hours worked per week

would have to be gradually decreased to insure that there would be jobs

for everyone.

Richard P. Eastman:

"Full Employment" is a bogus goal. The error gained prominence from

Keynes who viewed the old excuse for depressions as "over production" --

but we know that there is no such thing -- in the Depression of the

1930's milk was thrown out and crops burned because there was

insufficient demand due to insufficient purchasing power in the hands of

the people. Keynes put his name to the General Theory because he sold

out -- making millions in 1930 -- to the schemers behind the

depression. Montegu Norman and Bernard Baruch among them. Keynes book

was written by a circle of agents of the City of London. At any rate,

Keynes theory was that when factories were idled because of

"overproduction" or "underconsumption" the solution was not Social

Credit -- Keynes was bought to be the figurehead of "the new economics"

that was simply change the packaging of the old system and sell that to

the country, pushing the Social Credit reformers aside.

Keynes had a good reputation because of

his book The Economic Consequences of the Peace -- which described the

mistakes of the Versailles treaty in demanding impossible reparations

for Germany when Germany was not the country that kept the war going and

when Germany was the country that first agreed to quit the war and

accept Wilson's Fourteen Points -- which they never got. Keynes was

right and got the international respect he deserved for being right.

Keynes also was right when he wrote a shorter piece in 1925 called "The

Economic Consequences of Mr. Churchill" in which he foresaw the

consequences of Winston Churchill, then the Chancellor of the

Exchequer who did a Ron Paul and put Britain on the Gold Standard at

pre-war gold-content of the British pound -- this in order that the

British ruling and financial elite -- who loaned money in the war effort

would now enjoy the windfall that goes to creditors when debts incurred

earlier as paper must now be paid in gold at a gold per dollar price (in

this case the pound) that represents an incredible amount of purchasing

power that must be earned with an incredibly larger amount of labor for

the debtor to meet his debt obligations -- of meeting the government's

war-debt obligations through the paying of higher taxes through

revaluation upward due to the arbitrary setting of the currency's gold

content so high.

Note: All fooled people who follow Celente, Paul, Beck and all of the

pundits with gold-dealer sponsors -- need to know that the Rothschilds

monopolize money to scam people in this way -- right now they are

selling their gold accumulation at incredible prices as people panic

into turning over their purchasing power for this dead metal. They will

get it all back again after the fall of the US. The equipment for

detecting gold at a distance by its density is already mass produced and

standing in readiness for the day gold confiscation comes. You Ron

Paulers really made a big mistake when you bet on gold instead of on

saving your country with good domestic investments in productive

capacity and store of provisions for what is ahead. I say this over and

over -- no Ron Pauler or Becker or Celenteist seems interested in

defending their position against these criticisms. I wonder why?

At any rate, back to Keynes and Keynesianism -- his remedy for a

shortage of "aggregate demand" his name covering the real problem of

insufficient purchasing power for wage earners to buy products that have

to cover production costs that include both wages, profits and usury --

his "solution" was to have the government borrow money from the

Rothschilds and use it to "stimulate" the economy, to "prime the pump,"

with growth of government. But Keynes ignored the fact that the

stimulus comes from borrowing which only adds to the interest burden.

He thought the "stimulus" would increase production enough that the

increased debt could be paid off -- forgetting that a stimulus that is

debt financed is nothing but "junk food" -- eventually draining out

more than in pumps in.

Mark S.

Bilk:

Already, lots of people work at jobs that produce nothing, or

even do harm, like most advertising, real-estate and stock speculation,

enforcement of laws against cannabis, and imprisoning people who use

this herb (which is far less harmful than alcohol, and actually

beneficial in some circumstances if used correctly). I think these

non-productive and anti-productive jobs exist partly because with full

employment, people would only have to work 20 or less hours per week to

produce everything that they consume.

Richard P. Eastman:

Yes, the Dilbert comic strips are not far from the truth of corporation

world. A corporation is nothing but a small communist state -- they are

run internally like the Soviet Union while outside they thrive because

of monopoly power and other government bestowed anti-competitive

privileges. Single proprietorships like Henry Ford, Thomas Edison,

Henry Kaiser, Walt Disney, and perhaps Bill Gates always outperform a

corporation apart from any exclusive patents they may have purchases.

Most of the government is inefficient. For every person caring for the

retarded for example, eighty percent of paychecks go to administrative

and consultant personnel who never work directly with the residents.

In fact when cuts have to be made, the skilled hands-on caregivers and

the group home are replaced by an apartment with uninsured street people

hired to be "caregivers" while compensation for bureaucracy and

consultants remains undiminished. (I was the administrator of a group

home for severe-profound developmentally developed youth at the time

care for people with developmental disabilities was being gutted in

Washington State. The state was totally dishonest and it came from the

top down.

With Social Credit people will have the money to buy care for their own,

without the state. People do not realize that the real enemy of

socialism as well as of usury capitalism is Social Credit. I agree that

Wall Street cares very little about entrepreneurship and investment in

America -- it is all about speculation and grabbing peoples incomes so

the billionaires can use it for their "o.p.m." leveraged buyouts etc.

And you know I will never agree with you on marijuana being good for

people. I have seen to many people, once sharp, become lotus eaters

talking and thinking like Cheech-and-Chong (hey, remember them,

man?) -- As you know I nevertheless favor the government providing

every addict with his substance at cost or for free -- i.e., pennies,

grown on government farms etc. -- in order that people will not rob and

kill to get money for drugs and in order that all those trillions of

dollars don't keep ending up in the hands of

Rockefeller/Rothschild/Israel/China hands.

People adopting Social Credit around the world will not knock out

Rothschild/Rockefeller organized crime unless the profit is taken out of

cocaine and heroin and other addictive drugs. When drugs are provided

to all addicts no questions asked for pennies -- the pushers will

disappear -- the pressure will be off to take it. The jails will be

empty. People can get back to work again -- possibly with addiction

health advice and therapy provided by private charities or local or

state taxes. But yes, I agree there is a lot of busy waste in

corporations -- especially because of nepotism -- keeping it in the

families, while our ruling elite are jjust as sorry as the sorriest

bunch of clowns any declining civilization has had to endure.

Mark S.

Bilk:

Also, the state-run banks that make interest-free loans to

businesses would have to require some collateral and/or would have to

evaluate the soundness of the business plans. And the borrowers would

have to be legally bound to pay the money back. Otherwise there would

be all kinds of con-men borrowing money and absconding with it. Right?

Richard P. Eastman: Banks

would charge interest on loans, but the loans would not be the source of

our money supply. Banks for business and home building investments

would have 100 percent backing -- they would actually pay savers to

actually lend to the banks -- say at 3% on the same terms that the

banks, after bundling up the savings deposits to make big loans, would

offer, say 6% to entrepreneur borrowers. These banks would thus not

control the money supply in any way. It costs them to keep depositors'

money in the vaults, since they are paying 3% for them to have the

deposit, and so they will lend the money as quickly as possible to the

entrepreneur with the most promise of being successful, paying the loan

back and then coming to make a bigger loan. etc. Notice that banks

become only savings banks. The checking account function, and

clearing checks, could be done through the Social Credit Agency as a

public service -- people would use their Social Credit Card for

everything -- the Social Credit dividend simply being added to

everyone’s account at the specified time etc. Remember, no more

fractional reserve banking -- no more creation of money out of thin air

because of the fractional reserve system. Banks will simply be

borrowers from the many at low interest in order to be lenders to the

few entrepreneurs who have worthy ideas that require a lot of capital

for start up. Muslim banking principles would also be allowed under

Social Credit -- where the bank becomes a partner in the profits and the

depositors get, not interest, but a yet smaller share of the profit --

profit sharing on top of principal instead of interest on top of

principal.

Profit sharing with the banks will last

as long as the loan is paid off. Lots of

room for creative finance this side of usury.

Mark S.

Bilk: Oops, here's

another point. The people in charge of handing out social credit

money, and the people running the state interest-free banks, would have

to be watched and controlled very carefully, and accurate descriptions

of all their actions made instantly available to the public (via the

Internet). Because the dynamics of such a situation, with people having

power over the well-being of others, invites power-hungry people to seek

those jobs, and also invites massive corruption. Whether they're called

commissars under communism/socialism, or administrators under

populism/social-credit, the psychological factors of the situation are

the same.

Richard P. Eastman:

On the second Tuesday of each month, before live television, the

comptroller of the National Social Credit Service and the official

Dispenser of the Dividend will go to a small round domed marble building

with a single room under the dome and space for cameramen and

witnesses. Directly under the dome will be granite block with a

numerical keyboard and no letter keys and a windows to type in the date

of entry, 9-21-2010, the day the dividend will be deposited and the

dividend amount each person will receive, say $200; and then both the

Comptroller and the Dispenser of the Dividend will insert their

individual keys which when both turned will activate the "enter" key

which will be the entry, authorization and instruction for the

distribution of that amount to each person's Social Credit Card to be

created -- out of thin-air and without having to be paid back -- to be

received at 12:01 am on the first of the month, Friday October 1. The

granite "credit stone" will automatically reset to receive the next

entry on third Tuesday in October for the amount specified. Then they

lock up the Chamber of Social Credit until the next month.

But what about verifiability? Well,

since everybody in the country gets the same amount, it is no invasion

of privacy to provide that every citizen's name and city shall be listed

on a Social Credit Website showing exactly the amount that the single

specified amount was indeed created in that persons account. (It is an

error to say the money was "transferred" to people’s accounts. It is

created in those accounts by the Social Credit Agency -- but the Social

Credit agency is not debiting its own accounts. The Social Credit

agency has no accounts, no deposits, no money. It merely says "let

there be money in each persons account" and it is done. Now everyone

will know what the social credit dividend is each month and each can

check the amount against what was created for them -- and so can

everybody else check to see that everyone else got the same thing. If

people do not consent to have their names on the citizen roster to

receive the created dividend then it it will simply be electronically

impossible for them to receive their dividend. But the ultimate

fail-safe is this: the program will be hard wired in such a way that

everyone receives their created dividend together -- that there is no

way for the system to look up an individual and change his dividend

amount from what everybody else gets.

Public inspections of the software, with public access video of the entire process. The system will be too simple to hack.

Another fail safe could be that social

credit money must all be either spent or converted to paper cash by the

next month. That way no Social Credit Card will ever have more on it

than the specified amount for the current month. Grocery stores, could

simply give cash back for unspent social credit in a given month.

I think such a system would be much less

prone to tampering, embezzlement and fraud than the system we have now

or any other system I have ever heard of.

![]()

Third Tuesday of Every Month - Social Credit Dividends Created

Why Not?

finis

|

One More Review of the

Basic Idea |

Social Credit

is Household Spending Power -- sent to everybody like electric power

from a public utility.

It is real unborrowed legal tender

money that households receive to spend as they choose and never have to

pay back.

From where? Who pays for it? From

"thin air" and from the fact that good money managed nationally in this

way creates an economic pie as no other system. It is money from the

same "magic hat" that the Rothschilds have monopolized and from which

they have from "thin air" made their loans in usury. Money from the

same store of assets and potential that the Rothschilds got all their

wealth from when they monopolize credit and lend to us for their own

interest-harvesting, as they farm the fruits of our labors at our very

great expense.

(Webmaster's note:

The Rothschilds' Assets Total $500 Trillion Dollars. Think about

it. This is obscene. The Rothschilds must also make and

create wars to finance the debt created by their usurious system.

Social credit, a non-usurious system is what we should fight and die for

to bring in real freedom, peace and prosperity not only for the nation,

but for the whole Human Race -- and NOT for these Financial

Gluttons and their artificially created and generated wars based on pure

lies, deception and propaganda. Wars in other people's lands are

simply to maintain their system of usury.)

===========

Government administered basic-right dividend checks to everyone providing interest free 'money' backed by the willing acceptance of the entire nation in acknowledgement of the great benefit the system provides at so little cost to the nation. The power of money at the service of all from out of thin air and right to your own home.

===========

|

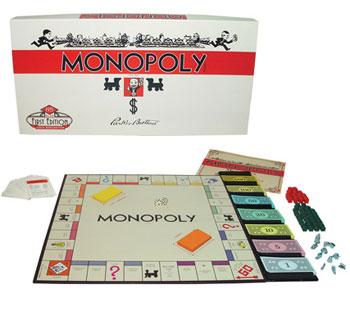

The

Monopoly Game |

“Now you're going to have to make things a whole lot simpler if you want

us to understand what Social Credit is all about."

"All right, Paul. We will try. On your planet

you have a game, a game played on a board

with pictures and slips of paper indicating purchasing power and other

pieces

of paper called deeds. I believe this game is called 'Monopoly.'

Here, let me show you a picture of it on the

Explain-tron."

"In this game everyone is supposed to start out with a certain amount of

money according to the rules.

The object of the game is to buy property and get money and build

rental houses and hotels

and charge people money if they stay at those houses and hotels until you

become rich

and everyone else loses all their money and property."

Monopoly Under

Rothefeller Rules

Under Rothefeller rules all players start out with no purchasing power

at all.

One player gets to be banker.

The banker is chosen by himself. Anyone who does not accept him as banker is not allowed to play the game.

In

the begining the banker has all the money -- his money and the bank's

money are mixed together and there

is no telling the two apart.

In

order for other players to enter the game they must borrow purchasing

power from the banker

at a percent that the banker specifies.

All players entering the game must pay the banker interest on the money they are using every time they pass "Go."

The banker may buy houses and hotels with the money of the bank. If other players should be lucky enough to own a house or two but then fall behind in his payments to the banker his property can be auctioned off and the banker who can outbid anyone because he has use of the bank til ends up owning all properties and buildings.

Under Rothefeller rules the banker gets to mix his money and the bank's money.

Now this system is like the one you have now here on your planet, Earth.

|

On our planet, Marva, we once had a similar economic system,

but we found that everything always ended up belonging to the

player who named himself banker.

At first we did not know what to do.

One man suggested that we should change the rules so that

instead of paper purchasing power borrowed from the bank that

thin plates made of gold be used for money instead. But of

course to get the gold purchasing power plates so you could play

the game you had to first buy or borrow them from the banker,

because he owned everything including all of the gold on our

planet. To buy the golden money ordinary players had to borrow

even more from the banker to get started in the game. However

once people did all this and had their golden money tokens they

found to their surprise that it did not solve any of the

problems that having gold money was supposed to solve. It just

made the poor people poorer and the banker a much more powerful

monopolist. Finally someone came up with the idea of Social Credit -- which was to give everyone outright and with no interest an amount of money at the start of the game and at regular intervals throughout the game so that they can stay in the game. Then we added the rule that no one can own more than three hotels. And finally we made the rule that the bank money and the richest player's money should no longer be mixed -- that the banks should be impartial and rule governed and that the money people use should be debt free. Of course no one loses and is forced out of the game under that system -- everyone stays in the game, using the money they get to improve their lives and invent and create and think thoughts and do the things they like to do, buying and selling, and even competing to provide better products and services -- while the money system simply is there to let them do it. Why should someone spend all of his time getting some property and putting a house on it only to have the house have to be auctioned off and the property auctioned off because that person can't pay the banker the interest on the purchasing power with which he staked that person's entry to the game? Who gave the banker that position and privilege? Are you understanding me, Paul? |

End of Lesson on How to Free Planet Earth

from the Only Alien Invaders the Earth People will ever Need to Call

The Enemy

|

How Do Social Credit Populists View the Economy? |

First, as a system where the ruling elite, that is the financial elite, have separated the money circulation of the common people from the money of the elites. They have the real purchasing power – and they have it in plentiful quantities – and we are the inmates of the asylum on a token economy, the Debtor's Prison for the Dumbed Down kept on short rations. But what about China and us buying from the Chinese? The fact is that at the low labor costs that the International Money Power pays to make the goods we import, we should be paying much less than we have been. Deflation and monopoly pricing have kept the retail prices only marginally less expensive to us than where the good made in the US – even though the labor price difference is (was) tremendous. But why? Because the international money power wants to use its dollars to build Chinese factories paying little, but they do not want us buying Chinese products at equivalent discounts. The upper loop buys Chinese at low Chinese prices. The lower loop buys Chinese at high almost-American prices – prices just enough lower than American prices to drive American firms out of business, but no lower!

Second, we should view the economy as a two loop system in which the master players who use the top loop, will arrange booms and busts for the lower loop. Why? Because of the A+B problem – the chronic tendency to insufficent purchasing power to sustain domestic industry due to the flow of investment loans and housing loans to households and businesses being less than the flow of investment loan principal and compound interest on those loans being paid back – is a problem that justifies to the people the instigation of an inflationary boom to "end the recession/depression" – during which time interest rates climb – if for no other reason than that an "inflation premium" is being added on by lenders – but also because, since it is a boom, those high rates are what the traffic will bear.

But guess what?

There is another reason why interest rates are high in the inflationary boom – or should I say – why the high interest rates and inflation always recur together. On top of inflation premium and high investment demand in a boom economy, there is also the reason that the Money Power lenders know that the end of the boom will be another depression with deflation – usually imposed Rothbard-Volker deflation to "fix" the inflation problem – and that means that the inflation premium they charged to lenders now becomes a giant windfall to the creditors. Oh, wow! We have just explained why booms and busts won't go away until usury is done away with. Let me restate it so you are sure to get it: Lenders not only offer loanable funds at high interest rates because they require an inflation premium, they also lend because they expect a subsequent windfall when the deflationary "correction" is arranged.

How does the deflationary correction occur? Simply by turning off the credit -- or even faster – calling in loans – as the Great Depression (the first one) was begun when Wall Street initiated the margin calls on the three black days – which works with a money-multiplier effect to contract currency in circulation and create the dearth of sales that soon leads to firing of workers and the shutting down and bankruptcy of firms etc. They bring it on deliberately. "They" being the credit monopoly.

=====================

If in a depression a

reduction in taxes is deemed beneficial then why should there be any

objection at all to social credit. What is the difference between tax

going down from $5000 to $4500 and tax doing down from $500 to -$500

(i.e. a negative tax were the householder gets money instead of paying

for it.

But with social credit there are two reasons why the new money will not

be harmful. 1) It goes to households for spending and not to

corporations for investing when US corporations, corporations that who

haven't a clue about household demand other than that it doesn't exist

because of lack of purchasing power. This means the new money will not

go to "malinvestment." The demand is real – it reflects what households

want and it is true purchasing power that will reward the entrepreneur

who best satisfied that demand. Money for big windmills and for tearing

down hydroelectric dams and for war on all Islam – does not result in

more domestically produced economic pie for citizens. But with social

credit – the housewife with her social credit dividend check has money

and only wants to spend it on economic pie that is good for her family.

And with the social credit dividend check coming regularly – and

debt-free – and never having to be paid back – there is not going to be

any contraction of credit which is associated with every debt-financed

credit expansion or debt-financed stimulus "malinvestment" by Government

(which is what Obama economics is all about).

|

How the Rothschilds Began their Fraud and Thievery |

|

How

to Institute Social Credit and Debt Free |

In all future elections vote only only for candidates who sign a pledge to:

1) break relations with Zionistan

(2) repudiate Rothschild debt

(3) switch to a debt-free fiat Treasury Dollar

(4) monetize the domestic economy with Social Credit dividend checks to all households rather than throwing our money away on the irrational and criminal measures of:

a) multi-trillion-dollar tribute to Rothschild/Rockefeller to "stimulate" / reinforce their ambitions of self-deification within the galaxy (or whatever);

b) debt-based bubbles to a housing market where no one can afford houses -- like throwing a ball with a big rubber band on it, the interest on the debt will always snap you back to depression:

c) open market purchases of securities that flood the international loanable funds markets with money that will never be invested in US productivity (i.e. easy money for the rich that never trickles down to the loop where the non-elite people earn and spend and look for jobs.

Forget the mumbo-jumbo superstition of the High-Priests of Finance which says that government can't print up its own money but must have Rothschild (whose interests own the Fed) print it up and charge interest for each dollar created -- and then charge the interest again when the money is deposited and serves as bank reserves. Good inflation is not only good -- it is essential to our recovery and survival. Giving Rothschild the levers to inflate and deflate where and when they want is like (or just plain is) putting yourselves at the mercy of a gang of sociopathic killers. Inflation is the only good way for governments to intelligently create the purchasing power the people need to produce goods for each others use. Remember -- the car won't go right unless there is air in the tires -- and it is better to inflate with free air rather than with air you have to pay for at compound interest. And no way should Rothschild/Rockefeller be the ones to decide who gets and spends the new money first. Everyone should get a per capital share of the new money that enters the circular flow -- money in the form of social credit dividend checks to households.

And so far no libertarian, monetarist, Keynesian or neo-classical economist or any other economist has dared come against that fact. They can't. If they debate it they lose. And they know it.he ontem that gets both big Government and big Usury out of the people's market economy.

|

The Conspiracy of Economic Gurus

and Pundits |

Everyone with eyes sees the collapse of the American economy due to the

parasitic usury component and private monopoly of money and credit and

money distribution for first-spender advantages.

But none are telling you that the disaster can be averted. None are

pointing out exactly which faulty components have left the door open for

the few in a position to handle the controls to rob and destroy until

there is nothing left for the families of mankind to live on. Even

their taking of a trillion dollars from future tax payers -- they then

demand for fixing the problem -- more money, which of course they will

not lend to anyone who would invest in domestic production.

Who would invest in a nation where it is no so clear that even money

loaned at zero nominal interest rate will be prohibitively high because

of the very high deflation premium that must be paid back -- because

entrepreneurs see that Americans will buy less, not more in the future,

despite the "stimulus bailout" given to the banks with no obligation

placed on them of what they must do with the money. (What they are

doing is hoarding dollars, even selling their gold to obtain them,

because the dollar is their currency, not ours. They are buying dollars

at the bottom, knowing that once they own all of the asset in America

and the middle class have been killed off, or else dumbed down and

pushed to slum rental housing and near subsistence wages -- and futures

for their children that are hard brutal and short. The dollar will

remain their currency to the end -- its connection with the United

States completely broken.

While you were waiting for hyperinflation -- you made all of the fatal

mistakes that one makes in a deflation. Meanwhile they positioned

themselves to take full advantage of the deflation which they knew was

coming because they were the ones who had the power to make it come or

not. They accumulated everyone's IOU -- but they were not after earning

streams of interest income this time. Rather they were after the

collateral on those loans. All of those middle homes they wanted to

become their rental properties. All those businesses that compete with

their Chinese industrial plants they wanted foreclosed and cannibalized

and put out of business -- providing them with monopoly power through

market concentration, through the economic death of all of their

competitors. And especially they wanted competitor banks, like

Washington Mutual, closed up or absorbed into their banks, like Chase.

They took on liabilities -- but that was only on paper -- what they got

was the title deeds to all of the valuable assets of the planet which

they did not already own. They knew Congress could simply be ordered to

whip the taxpayers some more subsidize -- as a stimulus bailout -- the

entire theft operation.

And so we have a housing market where the only people in a position to

buy are the elite of the financial sector -- who certainly don't by

these houses for themselves to live in -- or the foreign investor --

both looking for rental properties with good former-middle class tenants

who still remember how to mow lawns. The government buys the houses

that can't be sold because of insufficient demand and sits on them.

That keeps supply low enough to keep prices higher. Houses don't fall

in price to fit people's new lower incomes, and property taxes don't go

down, and debt still outstanding does not adjust downward to the new

deflationary depression prices they should be at -- all because of the

monopoly power of big finance. Libertarians are dead wrong.

Government does not make these messes -- the bankers do. If the

Libertarian eliminates the state --i.e. representative government, they

are merely turning themselves over to banker rule with privatized

mercenary debt collectors to replace the old tax collector. Yet the

people to not see the massive crime of the financial sector manipulating

to keep highly priced the assets acquired in foreclosure -- foreclosure

because of severe deflation (severe starvation for purchasing power in

the domestic production and household loop of the economy.) I am saying

that houses should be selling for $12,000 not $120,000; for $90,000, not

$300,000 but that government buying and withholding the "toxic" houses

to keep prices high is the problem. And of course in the face of the

purchasing power crunch local property taxes have increased not

decreased. All of this prevents the prices, wages, incomes, output,

purchasing power etc. from adjusting to allow the economy to recover

with proper balance of all of it's components.

I

have not heard one person comment favorably on my suggestion that debt

burden should be adjusted to an index to full-time wage earner

purchasing power -- or even average working day wage earnings. To

avoid giving the Financial Sector windfall

real-value-of-interest-payments-received profits from deflation -- by

adjusting the burden to deflation. Remember this -- when Bernanke super

inflates but the helium all misses the balloon -- don't expect any

lift. What you can expect is that the Money Power will end up owning

the balloon that you can't fly and you will end up paying for $20

trillion of helium released into the atmosphere to affect that

transaction. And right now the plan is to do it all over again. Why

not. So far it has never failed as a super efficient means to greater

wealth for the better banks and the better corporations owned by the

better people -- for the winners in this rigged game of strip-you-down

poker.

There is only one Macro solution for all this. We have to cut out some

defective financial systems and replace them with systems that to not

even offer the means for private Money Power manipulation. That solution

is 1) repudiation of debt 2) nationalization of money and credit --

taking it out of the hands of wall street and the city of London 3) an

impersonal mechanism that introduces money directly into the hands of

the consumers -- instead of into the hands of the speculators who then

bet the multi-national-corporations horses while fixing the races so

that only their horses can win etc. Under this plan -- called Social

Credit -- market demand will once again organize and build up

production to meet that demand. Where there are buyers with money there

industry will grow. That is what has been missing in this country

through its long tragic history under the power of

Rothschild/Rockefeller/Morgan/Baruch/Goldman-Sachs Usury.

|

Watching Out for the Charlatans Pushing Social Credit |

Populists are trying to

teach the public that the the economy has collapsed because of

insufficient purchasing power in the hands of the public. Of course the