Another Pathway is

Possible

No Human Being is an

Enemy of Another Human Being

The Holistic World Planetary Paradigm of The Spiritual UN

Caring About the Whole

Planet through

A Heart Centered Human Race for the Best in All

The Teilhard de Chardin Visionary Track for the Earth and Humanity

"Love is the affinity which links and

draws together the elements of the world... Love, in fact, is the agent

of universal synthesis."

Parting with War, Hate

and Fear of Others

—

“The line separating good & evil passes not through states, nor between

classes, nor between political parties either

– but right through every

human heart” :

Alexander Solzhenitsyn

Building a More Perfect Union

—

Where War is Not an

Option, But a Waste of All Life

—

Joining

the Eternal Vision

—

The

Peace and Brotherhood of

All

The Two-Tiered Economic System

—

The Free Flowing One They Have Created for Themselves,

and the Depression and Recession Creating One They

Have Installed for The Middle Classes

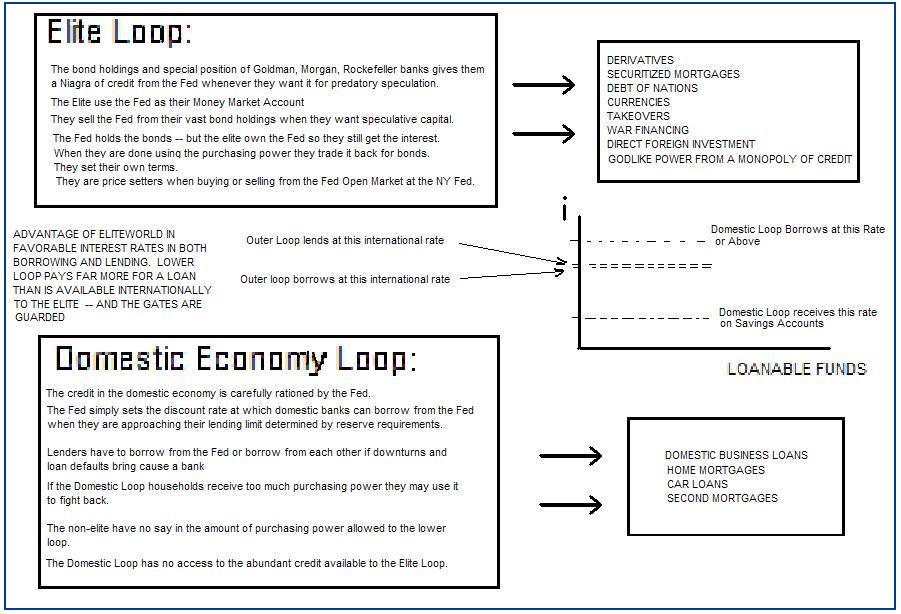

Elite Loop enjoy a Niagra of Credit -- and they set the terms on which they shall have it. The Open Market Trading Desk at the NY Federal Reserve Bank is their Money Market Account

The Lower Loop must take the small "inflation fighting ration of credit that the Fed allows when it sets the discount rate affecting the amount of loans outstanding, our M1 money supply.

There is only one way to fix this.

Look at this brief exchange between Hogwood and Goertzen:

Hogwood:

. . . the

"debt virus" fallacy that says, "The problem is that due to the

interest charge, ...the paying back the bank credit absorbs the

government fiat money, leaving insufficient for real current

market transactions.

Goertzen:

But the banks pay this money back into trade and commerce

when they pay their ordinary business expenses, their salaries

and wages, and also pay interest to their depositors".

I agree that the profits are plowed back into the economy.

The fact of the matter is that when more has to be paid

(monetary capital plus

interest) back - in the aggregate - than is

loaned into existence (monetary capita) there is has to be a

bookkeeping shortfall.

That shortfall is reflected (and maintained) by the increased

amount of debt carried by either or all individuals,

or corporations, or governments.

If one sector pays back its debt it puts an increased burden on

the other sectors.

The solution provided by the banking sector is to redefine

increasingly worthless collateral as worthy of loans.

Collateral was historically land, then stock and crops, for the

wholesale market, It has progressed to the point that collateral

can be identified as Potential earnings, or as one economist has

said, "the smell of a rose".

| Dick Eastman, in support of Goertzen and going somewhat further. |

Gentlemen,

Says Law -- roughly the belief that demand creates its own

supply and price level adjusts/equilibrates to money supply --

is defeated in the domestic economy when the financial system,

which is on a different loop but manages the loop of money token

circulation we are on -- injects a flow of new money in loans

but extracts money in a flow of money equal to the principal of

the loan plus compound interest, resulting in chronic deflation

--which -- seeing that borrowing always precedes paying back --

can only mean destruction for those operating exclusively in the

lower loop.

Furthermore, problems arise when organized crime gets hold of

the money supply and creates effectively two money systems, one

for each loop. The elite loop enjoys perpetual bounty of

abundant purchasing power whenever they need it and

interest-earning savings from securities and corporation bonds

when they don't need it. And the lower domestic economy loop

which is kept on starvation rations of purchasing power, just

enough to get the work done that the corporations want done --

like a nation of Wal Mart employees.

The abundance of easy money and perpetual boom time for the

elite loop comes in part by its engine of (M3) money creation,

the open market securities market of the New York Federal

Reserve, where the Fed becomes the money market account of

international speculators. When they want to plunder a nation

with loans or buy-outs they sell some of their trillions of bond

holdings to the Fed in exchange for a checking account which

counts as fresh surplus reserves which, under the existing

fractional reserve system, may be lent out except for the

fraction that must be held back for reserve. But the check that

is spent is also deposited and that amount also becomes fresh

reserves of which a fraction may be lent out, and that leads to

new check leads to another deposit and another loan until all of

the original amount has become required reserves holding a

multiple amount of loans afloat. This is the so-called

multiplier effect, whereby a small an initial amount of new

reserves created by an open market sale of securities to the Fed

results in a multiple of new money created within the system.

However, since the elite financial sector and the international

monopoly power corporations they float are all part of an elite

club or crime families' syndicate all of this multiplier effect

creation of investment wealth is kept within the elite circle,

within the upper loop. Remember, in the elite loop the New

York Fed is told by Wall Street and London (Rockefeller,

Goldman-Sachs, Morgan and some others] how many securities will

be bought or sold -- and the elite can stick whatever corporate

paper or securitized mortgage instruments they choose with the

Fed and there will not be any complaint. That is first-class

accommodations on "spaceship earth."

Meanwhile down here in the lower loop where, presumably, you

live and certainly where I live, we are kept on a much

stricter regimen. We never get to see any of that free-flowing

elastic Open Market money. Instead we live or die at the

pleasure of the discount window of the Federal Reserve which

dishes out M1 checkbook money to the prisoners, where banks can

lend their securities to the Fed for a short term loan of a

small amount of reserves to keep them from going under their

reserve requirement -- but that is entirely at the

discretion of the Fed. You see they dish out the low-calorie

non-nutritious food to the prisoners, but they do not have to

eat it themselves. Ours is the loop of checkbook money created

by bank loans -- bank loans that expand or contract also

according to a multiplier effect that is tied to the "discount

rate" which is the rate at which the Fed makes loans to banks to

keep them from falling below their reserve requirement. The Fed

is free to inflate this money supply at will -- whenever they

want to steal pockets of middle class savings or wreck the

system to force some new emergency financial legislation they

have devised for their benefit. Our loop gets its purchasing

power from domestic commercial banks and other lending

institutions. For example the elite controllers at the Fed who

manage our lower loop for the elite of the upper loop, can lend

everyone down here money for mortgages and second mortgages in

one period, and then have their monopoly oil companies raise

prices of gasoline so high that budgets of the lower loop

households and businesses are put in disarray and a series of

foreclosures occur -- after which the elite loop speculators can

sell some of their bonds to the fed and with the money buy up

all of the foreclosed properties at fireside prices. And of

course the public isn't told about the elite loop of elite

world.

So you who believe that profits are always plowed back into the

economy under Say's inviolable law -- think again. The money

we send into the Financial System as often as not never comes

around our way again.

Elite Loop enjoy a

Niagara of Credit -- and they set the terms. The Open Market

Trading Desk at the NY Federal Reserve Bank is Their Money

Market Account.![]()

The Lower Loop must take the small "inflation fighting ration of

credit that the Fed allows when it sets the discount rate

affecting the amount of loans outstanding, our M1 money supply.

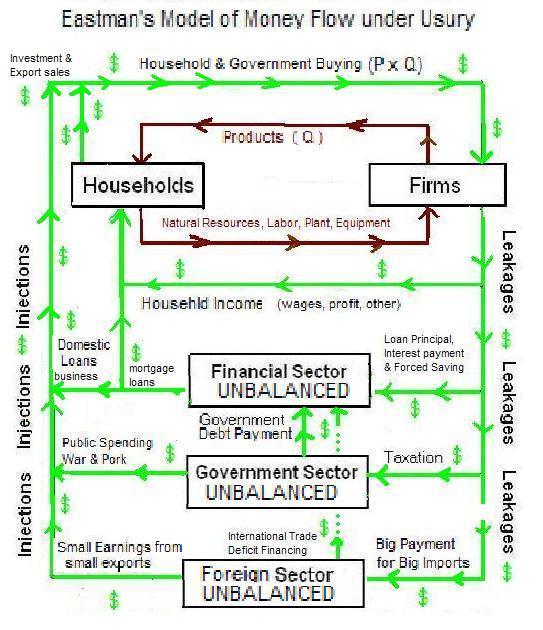

Furthermore, the elite loop like to play with the government

sector and the foreign trade sectors as well. They force the

government into debt -- or rather the stooges whose elections

they bankroll and promote on their monopoly Fox, CNN etc news

media under the phony two party system cheerfully let the

Goldman Sachs people on their staffs design the budget -- so

that the National Debt is so big and growing at compound

interest that what we put into government is also never comes

back to us, having been diverted to service the public debt.

And in the foreign trade sector, the elite loop speculators are

free to sell a few trillion of their securities to the Fed --

they own the Fed by the way, so they don't loss the interest, in

case you were worrying about that -- then lend money to us,

through second mortgages etc. so we can by from China and other

countries long after our manufacturing sector has fallen to ruin

-- the elite loop financed the industrialization of cheap-labor

China and they financed our buying from them even when were were

not selling anything abroad to pay for it with. You see, when

the elite sit down for a game of Monopoly, they play to win. So

the foreign trade sector is also out of balance, taking in money

that we have gone into debt to give them, and never sending any

back.

Their privilege in monopolizing credit comes at the expense of our privation (depriving us of our God-given right to life, liberty and happiness).

"Fix it with gold," did you say? How can you do that. The

elite own all the gold just like they own everything else. If

we get gold from them for our economy -- which they want us to

do, because then our debt obligations will have to be settled in

gold (even though what we borrowed as only "paper") -- we will

have to borrow the gold from them at interest to get the gold to

pay them in gold. (Everyone who is for a gold system is either

ignorant and too trusting or else an agent of the gold

monopolists. Again, there is nothing they want more than to

repeal legal tender laws -- which alone invests "paper" fiat

money with purchasing power -- and force a metallic standard.

Credit is like

water -- everybody should have some.

Social Credit is the only program provides elite-class credit to the American Household -- a regular and never ending stream of free-and-clear social credit dividend checks to each citizen -- replacing dependence on international bankers for our circulating purchasing power.

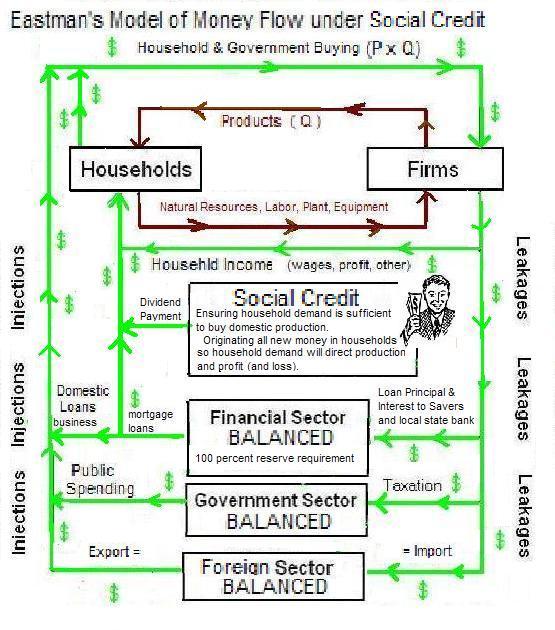

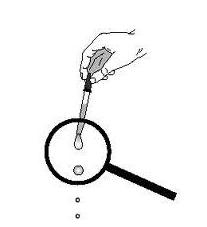

At any rate, here are two diagrams; one showing the failure of

Says law under the present Usury System and the other under a

system which does away with fractional reserve central bank

usury and institutes in its place direct tamper-proof social

credit payments, free and clear spending money, directly to

households so that the bottom loop denizens can be taken off

starvation rations and so that they can expect their creative

endeavors and good ideas to be profitable once in a while as

they finance their own way to a better future.

I write in full assurance that you both will pretend not to have

understood a word I have said, and am furthermore,

Yours sincerely,

Dick Eastman

Yakima, Washington

![]()

Exeter's

figures gives an idea of financial wealth magnitudes outside the

confines of the lower loop.

Below is a hasty diagram showing the problem. Note the spread

of interest rates which the elite international loop enjoys and

compare it with the high rates at which we, as prisoners of the

Lower Loop must pay to borrow.

Diagram one:

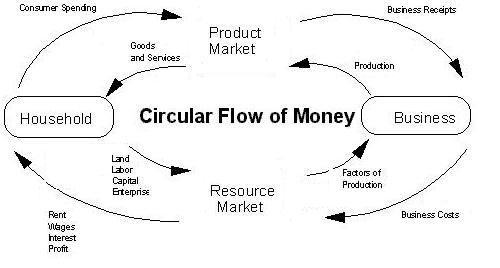

Say's Fallacy. This equilibrium where savings equals investment and

prices adjust so that all markets clear, never happens under

usury. Usury prevents the mechanisms described by Say from

reaching the evenly rotating or equilibrium state. Just look

around you and you will see that Say's Law does not obtain under

a system of monopoly power in money and finance.

![]()

Say's Law roughly claims that due to market adjustment of prices

in all sectors, business receipts will equal business costs --

demand will call forth equal supply. The law is violated

however when the interest component of business costs do not

find their way back to domestic economy Business receipts. (See

the next diagram.)

Here is what is really happening:

![]()

And here is what we can make happen:

![]()

How

to Fix Everything by

the Little Mailman of Bayberry Lane

The things people make and the people who get to own them depends on where our tokens for spending come from, and on who gets to spend those tokens first , and on how much they have to pay back later for being allowed spend those new tokens today.

Mr. Owl said to

me the other day that there are so many people making different

kinds of things with so many different kinds of machines and so

many different kinds of things that go into the things we buy

that we have to have Buying Tokens to make it all work. The

buying tokens pay people for working. When people spend the

tokens they earn that gives messages to other people about what

things people will pay the most to own. In bigger words the

entrepreneur must have the market price signals to decide which

things to produce and how to make them so he can most profitably

satisfy the people spending the tokens they earn.

Today things

are not going the way they are supposed to go and the reason has

to do with a man who makes spending tokens out of thin air, as

if by magic, and what that man demands back from people later on

for letting them be the first spenders of the money he makes out

of thin air today.

Now we all can think when thinking is important and nothing is more important than everyone getting all the food and clothing and pretty houses and other nice things that they want to be happy and to help the people they love to be happy too.

What is going wrong today and what can fix it is easy to understand if you ask the right questions and then think about the answers to these questions. There are only three big questions that we need to answer before we can fix everything up the way it is supposed to be.

This is how Mr.

Owl explained it to me:

The three great

questions:

1. Who gets to do the "thin air" trick that originates purchasing power,.

2. Who receives the new "thin air" spending tokens to become "first spender."

3. What "kickback" must Mr. First Spender pay to Mr. Thin Air for conferring the privilege of spending first?

Mr. Owl's

Glossery of Terms ( In case you need to look up a word as we go

along.)

thin air:

sovereign power to originate spending tokens

credit:

Mr. Thin Air's own best reasons for favoring Mr. First

Spender with getting "thin air" exchange tokens for first

spending over someone else who lives in the village getting

them.

kickback:

payments over time to Mr. Thin Air for allowing someone to be

a first spender. This tribute to Mr. Thin Air is called usury

or interest.

What are the

answers to these questions?

Let me tell

you.

Mr. Thin Air,

for allowing people to first-spend thin-air tokens, exacts

tribute in return. Mr. Thin Air receives for conferring

immediate use of his thin-air spending tokens, tribute that must

be gathered by toil and sacrifice, tribute of purchasing power

equaling the full first-spend amount plus an extra amount, to

be paid over time plus a compounding of amount as an

extra-amount owed also requires a tribute payment, according to

the ways of compound interest.

An ancestor of

Mr. Thin Air got his special thin-air privileges from a King in

return for easing the Kings debts or for giving the King some

gold to buy weapons to win a war that Thin Air's ancestor

actually instigated.

Since that time

the Thin Air tribe have gained control of the world, simply by

the power of introducing thin-air spending tokens and conferring

the power to be first spenders on condition of repayment in

toil-money plus usury.

Mr. Thin Air

has lots of reasons why he should hold on to his thin-air power

monopoly.

One reason he

gives is that he owns almost all the gold and keeps it in his

vaults and that the thin-air credit power just simply stems from

that "backing."

Another reason

that Mr. Thin Air gives for monopolizing thin-air powers is that

governments cannot be trusted not to create too much thin-air

money. Mr. Thin is against others having his thin-air powers

because he fears too much money would be pulled out of thin air,

that there would would be too many token claims to slices of

the national economic pie which would mean that the slice each

single token buys would become thinner and thinner -- and that

would be bad because the agreed-upon tribute First pays each

month, would each passing month represent less and purchasing

power than Mr. Thin originally envisioned when the contract with

Mr. First was signed. Mr. Thin calls this reason, the

"anti-inflationist" argument.

In addition to

being "anti-inflation," we should not, and for the same reason,

Mr. Thin Air is also a pro-deflationist -- although he

never mentions this or uses the fact as a reason for having him

retain his monopoly of thin-air and credit power.

Nevertheless his policy is that it is better for him to be very

stinting in the amount of first-spending of thin-air tokens he

allows since reducing the amount of thin-air tokens in the

hands of first spenders means there will be more economic pie

per token -- which means that his entire stock of tribute IOUs

that he hold will grow in value -- a much bigger gain from him

than he would have if he made a few more loans so purchasing

power in circulation would not deflate and his pile of IOU's

would not increase in value over time due to the deflation.

Mr Thin Air and

all of his ancestors through the centuries, like to convince

people that the thin-air power should be tied to gold reserves

because such an arrangement in always deflationary in the long

run. With thin-air power tied to the amount of gold in vaults

(as arbitrary an arrangement as any other charlatan money

scheme) there will never be deflation which to reduce the

purchasing power of the future loan payments he receives from

Mr. First Spender D.S.. However, as economies, being organic

things, usually grown if not mistreated too badly, Mr. Thin Air

can expect the benefit of continuous deflation as the amount of

economic pie will grow by a larger percent each year than the

percent gold miners will be able to increase the size of the

gold stock that backs thin-air money creation.

Of all things

in this universe Mr. Thin hates and fears the Social Credit idea

that American populists are just beginning to discover from the

writings men who went up against the Thin-Air Money Dynasty in

past ages of economic depression brought on by Mr. Thin Airs

favorite policies.

Under social

credit, the government takes over the thin-air function and

provides first-spending power to each person of each household.

Since everybody gets the same social credit amount of thin-air

purchasing power each month and since all will be affected by

inflation or deflation in the same way and by the same amount --

and since no social credit is paid to the government --

remember, the people own the government and any funds it obtains

must come from the people in taxes that are set by the people's

chosen representatives.

Under social

credit, then, there is no tribute, no debt slavery. You don't

have to pay back the amount of first spending purchasing power

given or interest on that purchasing power or the amount

represented by the extra toil and sacrifice needed to earn

tokens more hard to come by because of Mr. Thin's deflationary

policies.

Now you

understand social credit. Now you can read the following

correspondence on the subject -- outlining real solution to the

economic crisis -- which chisis is a supremely naughty

escapade by Mr. Thin Air which I call "the Kleptastrophe" --

and, hopefully, you will see that there is another way that

really is clearly true and superior and worth the effort of

using it to skate past hell and reach the future we really

always wanted.

The End.

Note the Little Mailman of Bayberry Lane wants you to send this

letter from him far and wide, so that we can all come to

agreement that this is the best way of fixing the things that

are wrong today.

When the Debt Slavery system suddenly withholds usury credit,

crashing the domestic economy, people can rescue themselves from

the plunderers by chucking the Usury System and substituting

Social Credit. They will quickly become far better off and

secure in their future prosperity than they have ever been

before. We simply take back our own credit which the Rothschild

interests have been monopolizing everywhere for centuries.

Social Credit is better.

Which system would you rather have?

(The War-Debt-Usury System)

System #1: The international bankers have monopoly of credit. They keep the credit tight to maximize loan income and the value of their debt portfolios. Unfortunately keeping the money supply tight means that the corporations they invest their money in and buy stock in do not have customers. So, hiring Israeli intelligence they pay for a false-flag attack in New York sky skrapers so they can have a war and a great need for anti-terrorism measures which their defense corporations can cater profitably, solving the problem of insufficient purchasing power to buy their products. They also create weather disasters and other disasters with secret technologies -- because the emergency services business and the reconstruction businesses are also lucrative -- paid for by government which borrows the money from the bankers to pay the corporations. etc. Meanwhile the people not involved with war industry or the disaster business continue to lose jobs and houses and standard of living because of lack of purchasing power.

or

System #2:

System #2: The government has debt-free treasury money that it

creates without borrowing from international bankers. They give

an amount of money to every American -- not a redistribution

of funds, but the government giving households the chance to

spend the new money into existence -- so that household demand

will guide the market economy. The entire economy will shift

away from catering war and disasters -- and from making war and

making disasters -- as people receive these checks and treat

them like they would a tax return or a dividend payment or a

pension check. People will still work for a living -- the

social credit does not replace work, or entrepreneurship, or the

market system, or earning a living -- what it replaces is the

way new money enters the economic loop. Let housewives again

decide what this country will make. And under this system the

domestic economy will get the stimulus, because American

families do not spend their money on war. Social credit is

the death knell for both finance capitalism and socialism and

the welfare state. There can be no free market system with

consumer sovereignty without social credit. Their can only be

poverty and war without Social Credit.![]()

Principle of economic freedom: Without Social Credit there is none. You are just a debt slave living at the sufferance of the elite.

Here is a more formal exposition of the usury

problem and the social credit solution.

A friend wrote:

Handing out money to average people might work if it was just

done as stimulus in small to medium amounts, But too much for

too long would devalue the money and stop some people from

working.

All it would require would be small and medium amounts of social credit dividend each month or quarter because those dollars would circulate many times in a year. That is, it would have velocity.

Remember the equation P x Q = M x V

Totals of all payment receipts showing Price @ Quantity in a

year (i.e. sum all all cash register receipts and other

receipts) EQUALS the amount dollars "M" that have been in

circulation (not being saved, i.e., unspent) at least once in

the time period TIMES the average number that each of those

dollars was spent to buy something from the production sector --

that number or rate is called Velocity (V). (Don't count

garage sales -- we are talking about new produced goods. ) In

other words Receipts (PxQ) equals Total Circulating Purchasing

Power which can by described symbolically this way:

P x Q = M x V which is an "identity", meaning that

it is always true. (Note the triple-bar equal sign -- which

means "always equal to" or "always true by definition")

Now we add an assumption to this identity -- the assumption that

velocity does not change -- then the equation, with V now a

constant, becomes the famous quantity theory of money.

Under the quantity theory of money -- if you add money -- that is, if you increase M, either more will be produced (a rise in Q) or prices will climb (an increase in P) or both. But also if you withdraw money (a removal of M from circulation) either P will go down or Q will go down. And of course if Quantity produced goes down wages, profits, will go down too even as failures to pay rent and debt will increase. That is the problem of deflation. That is the Quantity Theory of Money -- associated with the name of Irving Fisher.

But there is something else -- another fact that comes into

play.

Remember that P x Q = M x V is always true (not

making any assumptions about velocity). Velocity may increase

-- if people were paid every week instead of every two weeks

that would increase velocity by some.

Of course if dollars are saved rather than spent -- that will decrease M -- unless the money is saved in a bank and not in someone's mattress. If the money is put in a local bank -- then the bank may lend the money to build a house or to build a factory -- in which case M would keep circulating (buying producer goods instead of household goods). But something else comes into play that is the root of our problems.

That something is usury.

P x Q = M x V is always true.

But let consider the nature of loans, money creation and

interest. In our system of fractional reserve banking -- if a

bank gets a deposit of a dollar from someone's mattress -- the

law lets them lend all of that except a fraction -- say 10 per

cent. And as soon as the loan is made of 90 percent of the

original deposit, say to a building contractor, the contractor

goes and spend it and the electrician will get it and deposit it

his bank. And the electricians bank will take that deposit of

90 cents and will be able to lend out 90 percent of that 90

cents, that is 81 percent of the original deposit, keeping 9

cents as reserve. And do forth. So in the end each of the new

dollars from the mattress will create more purchasing power

because of these additional loans -- each new loan smaller than

the one before it -- so that, in fact, if the reserve

requirement is 10 percent the total amount of money

created/circulated due to loan expansion will be ten times the

amount that was taken from the mattress in the first place.

But what happens when money is taken out of circulation and put

in a mattress --or taken out of the country. We have the same

"multiplier effect" in reverse -- contracting the money in

circulation by ten times what was taken out. Instead of loans

being made, loans will be called in, loans will be defaulted on,

new loans will not be issued to replace retiring loans -- there

will be a monetary contraction leading to less spending,

layoffs, firings, business failures, cuts in quality of

ingredients, reduction of services and frills etc. etc. etc.

(look around you to see what I am talking about).

Only now are we ready to understand the true effect of the claw

of interest slavery -- the true cost of usury.

While it is always true that P x Q = M x V it is also

always true under the usury system that regardless of velocity

-- M will always tend to diminish because purchasing power is

leaking -- gushing -- tsunamiing out of the system to the

financial sector in the form of interest payments. 40 percent

of each price you pay at the store or the car showroom is to

cover interest as a cost of production to the producer that he

passes on to the consumer. Even more of each dollar in taxes

goes to pay interest on the national debt -- much of that going

to the Fed which owns a lot of our debt and much of it going to

foreign creditors who own United States securities and our state

and local bonds etc. The Fed is like a mattress -- because it

is not putting that money back into domestic economy

circulation. The Fed (under figurehead Bernanke) is buying up

securities and paying for them with new bank deposits -- there

are no printing presses when the Fed creates money -- to the

big financiers and financial institutions that sell the

securites to the Fed -- these financiers getting the new money

are not using it to invest in US domestic production. Anything

but that. Instead they are, by policy, letting deflation take

its toll domestically, while they apply their money overseas.

They buy goods of China and allow us to buy them with consumer

loans -- (called second mortgages) -- but the drain -- the

reduction of M -- continues to take its toll.

The result is the destruction of the country and the

accumulation of all of our dollars in China -- so that when the

time comes --China will not have to conquer this country, they

will just move in and buy it up, and evict us to the slum

holding pens (New York, L.A., Philadelphia, Detroit, Kansas

City, etc.) where we, with poor food, viruses, low income, high

crime will simply die off.

The alternative of course is social credit. But I can't seem to

make anyone see that an alternative is necessary.

The libertarians and conservatives and the people educated by

high-school education disc jockey Glenn Beck and Freemason

Statanist conspirator Ron Paul and Celente and Alex Jones etc.

seem to believe that we need to let the collapse happen to clear

out the mal-investment (when in fact when you took out your home

loan you were a good credit risk because of the job you had and

the prospects we all thought you had -- before the Kleptastrophe

crime cut us low. But they talk about a collapse being the

necessary cure -- like the medieval doctors bleeding their

patients and killing them while claiming they were trying to

kill them. And then after the collapse and the Chinese and

Rothschild/Rockefeller/Goldman creditors own everything --

including still outstanding IOUs of yours that they hold --

they will switch to a gold system in which you must slave all

the harder to pay your debts in gold.

I hope I have persuaded you of the life and death

importance of this analysis and the cure.

I am not an original thinker -- but I do have the gift of

detecting falsehood, finding the problem in systems, evaluating

solutions that others have offered to see if they really address

the problem or not. I completed two years towards the doctorate

at Texas A & M -- completing the prelim exam in macro with the

highest score -- however I have forgotten almost everything I

learned back then -- 30 years ago -- and only give to myself

the distinguished title of "student of economics" -- a title I

ask you to share with my by your diligent study and mastery of

the material I have passed on to you here. I have sacrificed my

life to gain the knowledge I have -- and to reach you with it.

I beg you to take seriously the possibility that there is

something good in this for all of us.

Sincerely yours,

Dick Eastman

Yakima, Washington

Post Script

No monetary reformer is on your side

who is not HONEST ABOUT EVERYTHING THAT IS GOING ON IN THE

WORLD.

The people who

made it to the top and have been rewarded with status and

exposure are generally people who compromised to get in the

gate.

I have I think looked long and hard at the problem we face and have come to the conclusion that all monetary reform -- including Social Credit and Treasury Money reform must fail unless it is accompanied by:

(1) total repudiation of all debt

contracts to organized crime now presiding over the

international financial system, and

(2) total renunciation of

the usury system as a way of funding government.

Nothing can

work without first removing these monsters from our backs and

throats once and for all time; and

3) total openness about the

incontrovertible mountain of independent lines of evidence each

proving conclusively that 9-11 was the work of Big Business and

International Finance and the espionage and black-op agencies of

the US, Britain and Israel tied by memberships in secret and

semi-secret organizations dedicated to world domination by a

criminal plutocracy. You need to be straight on whether you

are bass fishing or hunting grizzly bear. Otherwise you might

not be prepared to handle what you reel in.

|

|